US Flood Premium Potential More Than $41B

The total potential for residential flood premium in the contiguous United States is $41.6 billion, according to a report on the personal flood insurance market by data analytics and risk assessment firm Verisk Analytics. While flooding is the most frequent natural disaster in the United States, millions of homeowners do not purchase flood insurance to protect against this type of peril. Still more rely solely on the National Flood Insurance Program (NFIP) and its Write-Your-Own program.

Texas ranks among the top five states by total flood premium potential with more than $2 billion, along with New York, California, Florida, and Louisiana. According to the report, the top five counties in Texas by estimated premium potential are Harris ($868M), Fort Bend ($285M), Dallas ($251M), Bexar ($219M), and Tarrant ($212M).

As the NFIP has been reauthorized over the past few years, private flood insurance as an alternative option has gained more traction. In the Texas market, surplus lines flood premium has increased significantly over the past three years. In 2016, SLTX recorded $19.13 million in flood premium. The following year, in 2017, premium increased 73.18% to $33.13 million. 2018 saw a further 8.85% increase to $36.07 million, and SLTX has already recorded $31.50 million in 2019 flood premium, as of August 31, 2019.

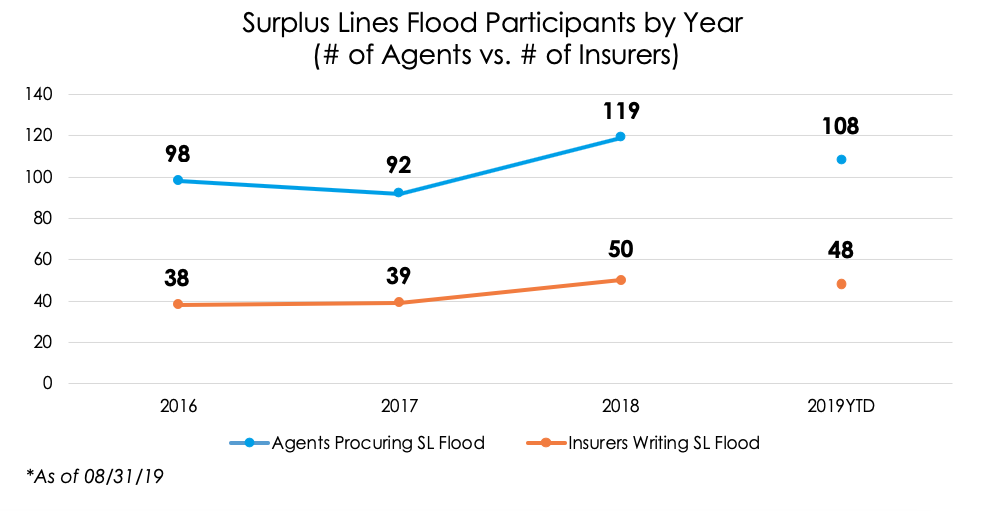

Additionally, the number of insurers writing and agents procuring flood coverage in the Texas surplus lines market has steadily increased over the past three years. While 98 surplus lines agents reported flood premium to SLTX in 2016, that number rose to 119 by the end of 2018, despite a slight dip in 2017. Likewise, 50 insurers wrote surplus lines flood coverage in Texas in 2018, up from 39 in 2017 and 38 in 2016.