SLTX Market Report

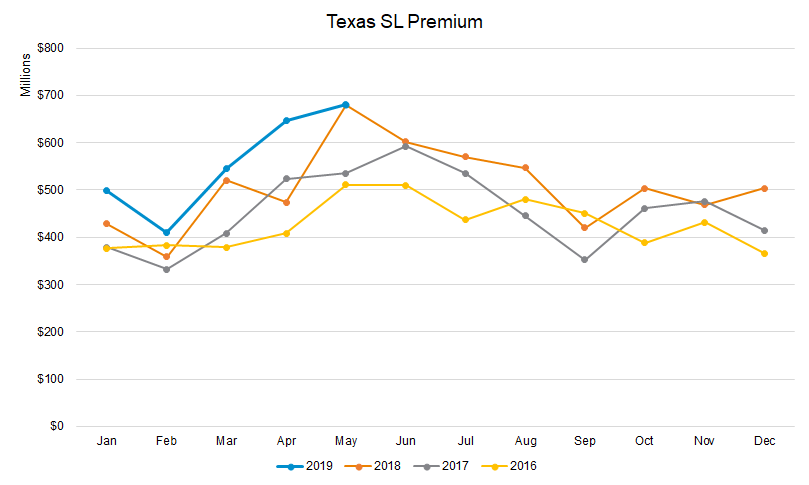

In Texas, SLTX has reported record premium growth in the first five months of the year, with each month being the highest on record for premium in that particular month. Pressure on the excess and surplus lines (E&S) market nationally could suggest a hardening property & casualty market in the US, according to executives in the specialty insurance industry.

Additionally, admitted property and casualty premiums have improved year-over-year nationally, increasing to $639 billion in 2018, up from $611 billion in 2017, according to an article by The Insurance Insider. Excess and surplus lines (E&S) direct written premiums have increased, as well, up to $35 billion in 2018, compared to $32 billion in 2017, via data from S&P Global.

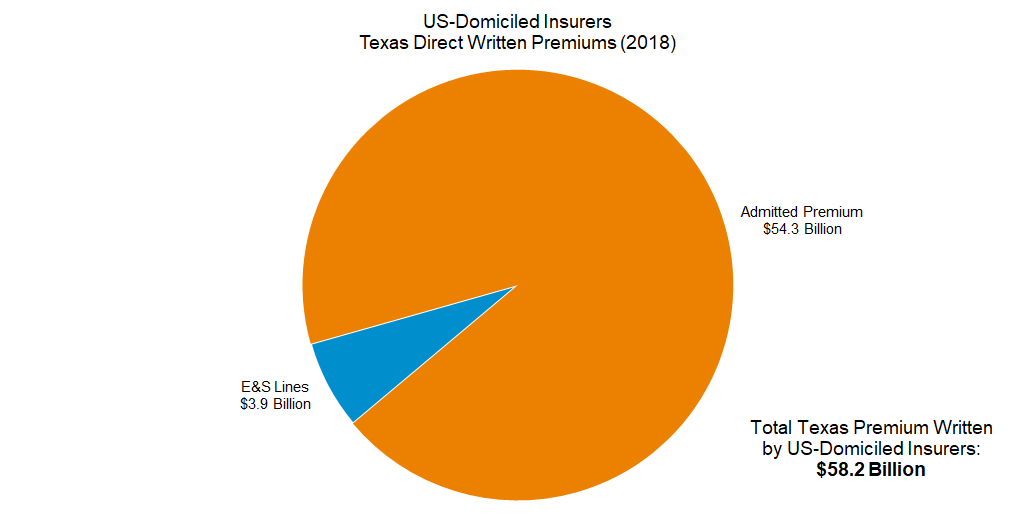

SLTX found that the Texas admitted market accounted for about $54.3 billion in direct written premiums in 2018, based on data from A.M. Best. Combined with $3.9 billion in E&S premium written by US-based insurers, the Texas market recorded $58.2 billion in total premium during 2018.

E&S submissions in the US have increased in 2019, owing to an uptick in consumer risk appetite, as stated in The Insurance Insider article. This may suggest stricter underwriting standards and lower risk appetites in the admitted market, leading to new submission activity where customers were not able to renew an existing admitted policy. Even while new business is growing, some specialty carriers have reduced costs in response to losses in recent years.

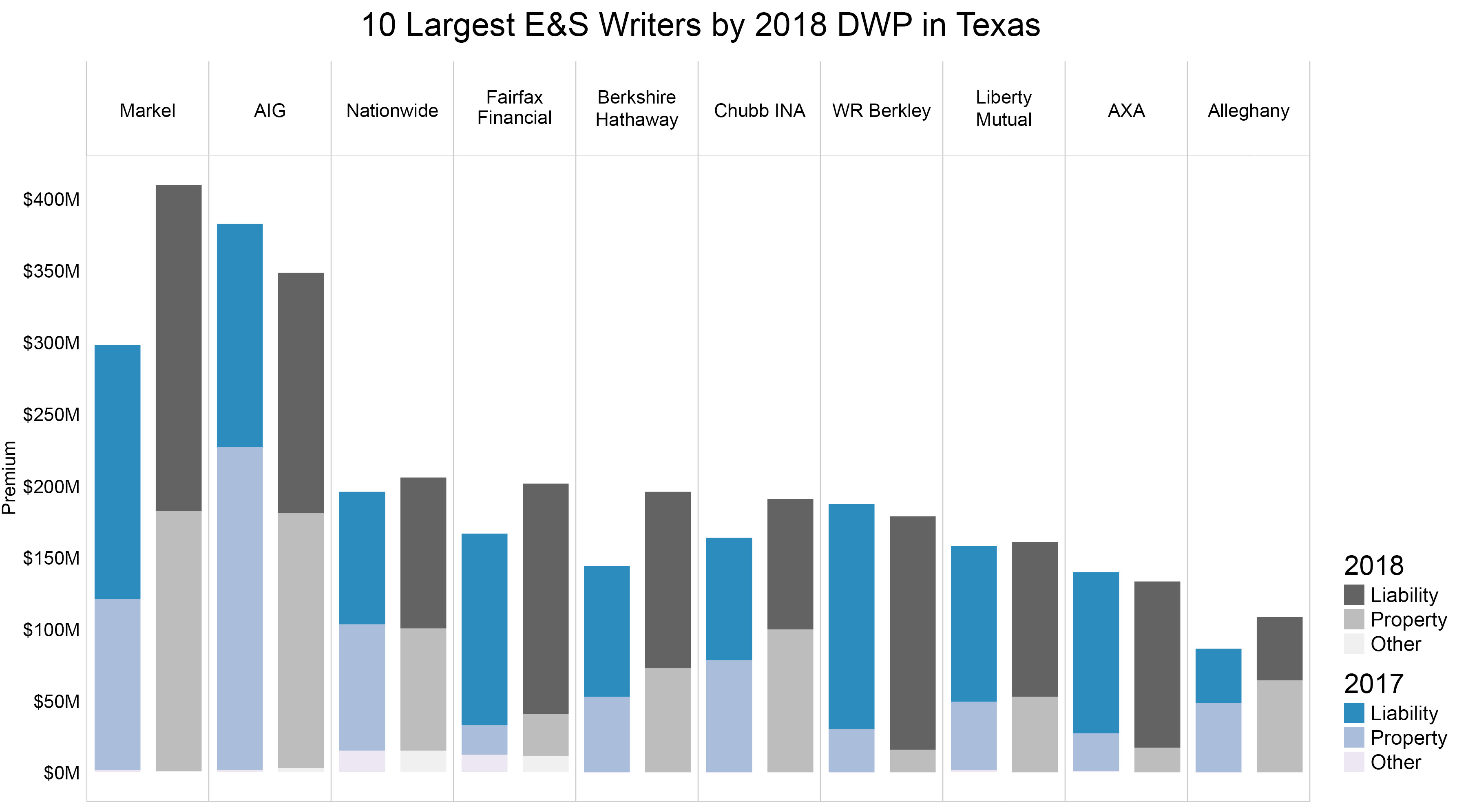

SLTX found that E&S companies writing in Texas experienced greater than expected losses in 2017 due to weather-related catastrophes but have not pulled back when it comes to their overall risk appetite and expected capacity. A majority of the 10 largest writers of E&S premium in Texas actually increased their DWP in 2018 over 2017 by 12.5% on average. Markel Corporation Group experienced the highest increase at 37.6%, followed by Berkshire Hathaway Insurance Group at 35.8%.

This chart breaks down the largest surplus lines writers by group in Texas, where the group has at least one (1) E&S writer. All data collected is Texas premium reported to SLTX in 2017 and 2018.

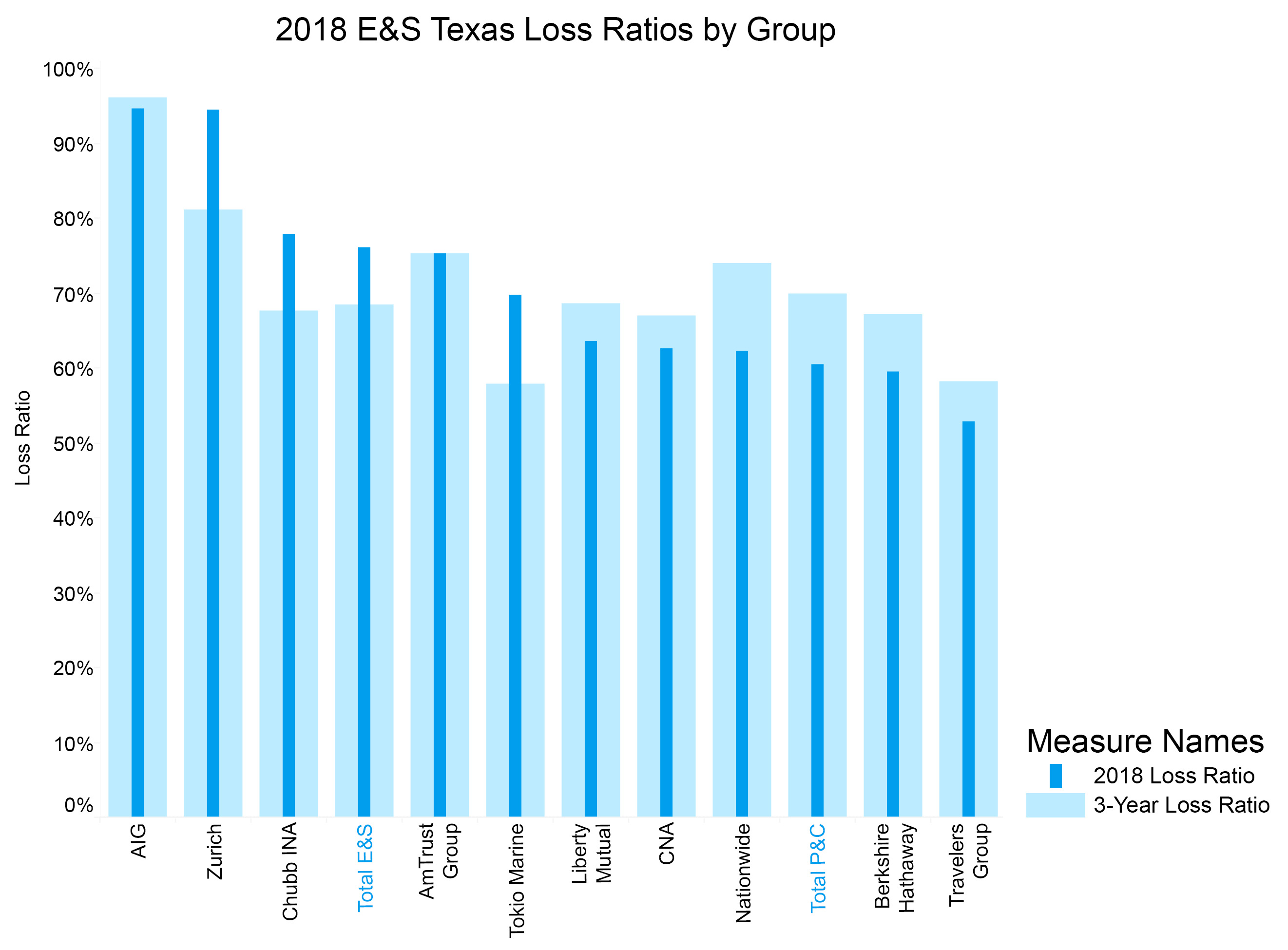

With respect to loss ratios and evaluating costs, SLTX noted that some of the top 10 E&S groups in Texas experienced 2018 loss ratios that were above their 3-year averages. As a whole, the E&S industry experienced larger losses in 2018 than in recent years.

This chart provides the 2018 Loss Ratio in Texas and the 3-year Loss Ratio by Group for the top 15 premium writers in Texas. This information was collected from A. M. Best loss information, as reflected on companies’ Schedule T form.

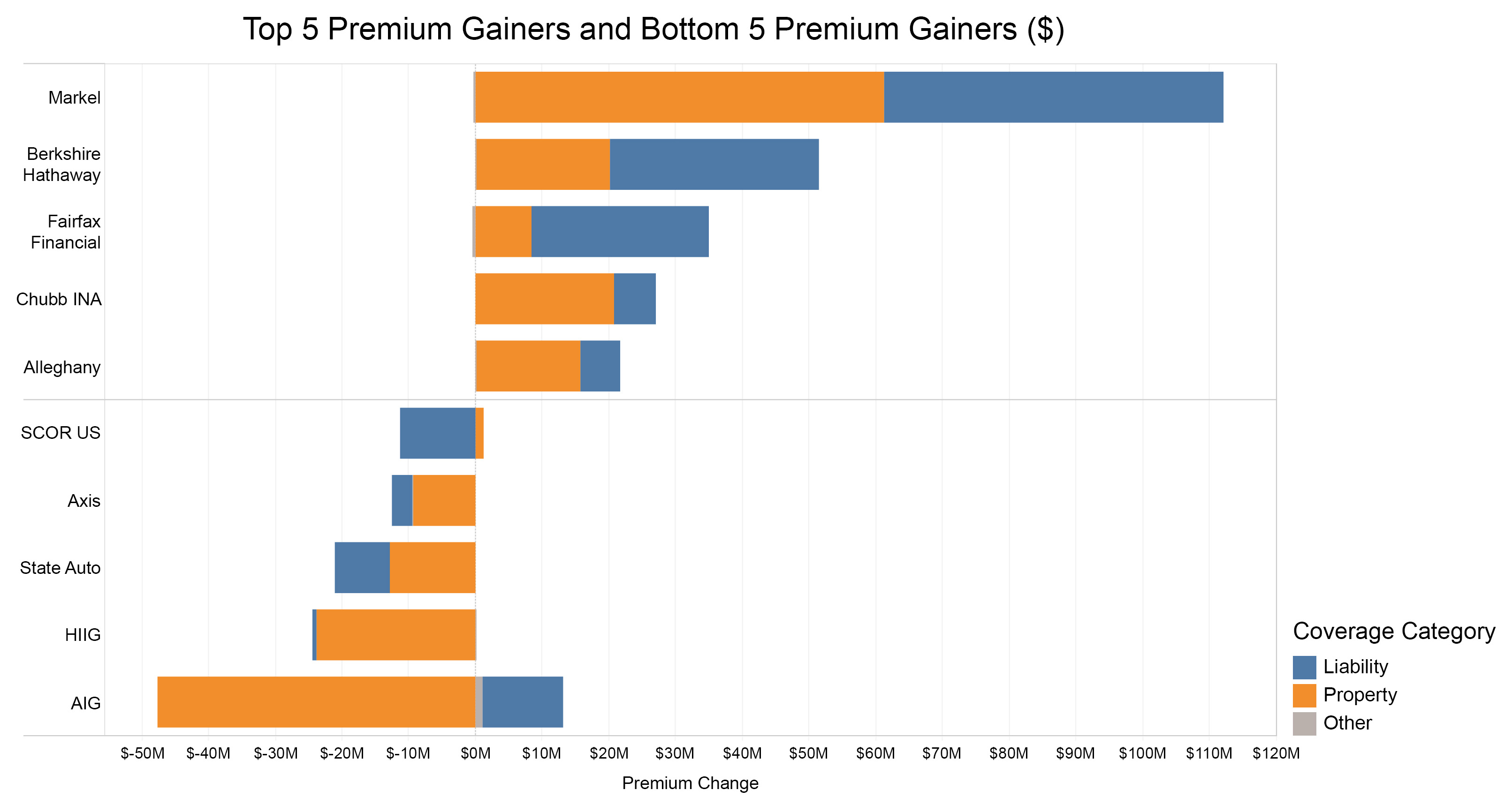

Overall Texas premium has continued a steady climb, but it is evident that some carriers have begun shifting risk profiles. Of the top five (5) companies who recorded the largest increases in premium, all had gains in both property and liability coverage. Of the five (5) with the largest decrease in premium, four (4) of the companies reported significant decreases in property coverage, whereas liability was not a coverage as heavily impacted.

This chart shows the groups with the greatest increase or decrease in Texas premium from 2017 to 2018, broken down by coverage category.

While specific groups have reduced costs in response to loss, Texas as a whole has not seen a decrease in premium. E&S property premium in the state increased by 12.0% in 2018, up to $2.74 billion from $2.45 billion in 2017. SLTX anticipates continued growth through the end of the year and expects peer surplus lines service markets across the nation will have similar growth outcomes for 2019 during mid-year analysis in the coming months.