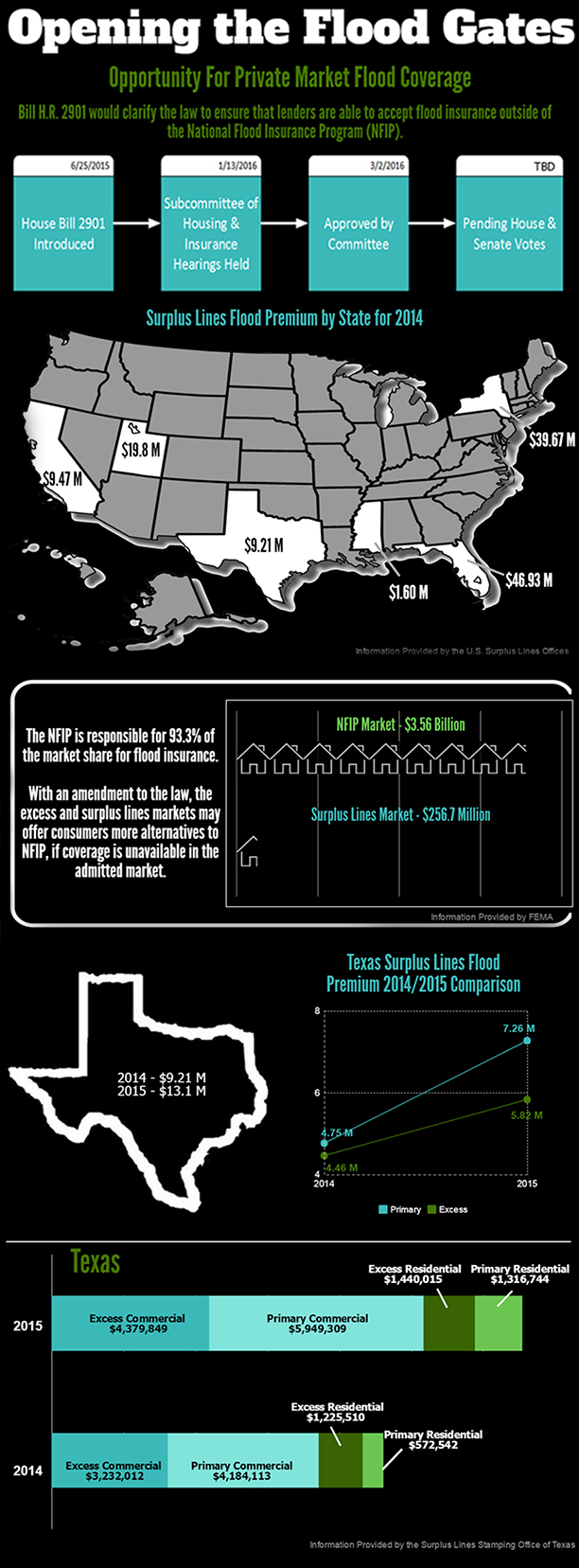

Opening the Flood Gates

Data reveals the excess and surplus lines markets are well positioned to take on additional flood risks.

Texas – In early 2016, the Surplus Lines Stamping Office of Texas gathered data on flood premium written within the state of Texas. This information along with several other states was provided by the National Association of Professional Surplus Lines Offices (NAPSLO) to Representative Maxine Waters (D – CA) for review in regards to H.R. 2901, a bill which aims to clarify to lenders that private insurance markets can provide flood insurance.

Six Surplus Lines offices provided flood data that accounted for $256.7 million in premium in 2014. In comparison, the National Flood Insurance Program (NFIP) wrote $3.56 billion. The NFIP is currently at a deficit of $23.8B and H.R. 2901 would provide more opportunities for private market participation to bear the risks that are currently shouldered by US taxpayers. The below noted infographic provides a quick educational summary of such findings.